- Best overall ADP alternative: Gusto

- Best for growth: Rippling

- Best for global payroll: Papaya Global

- Best for QuickBooks users: QuickBooks Payroll

- Best custom configurations: Paycor

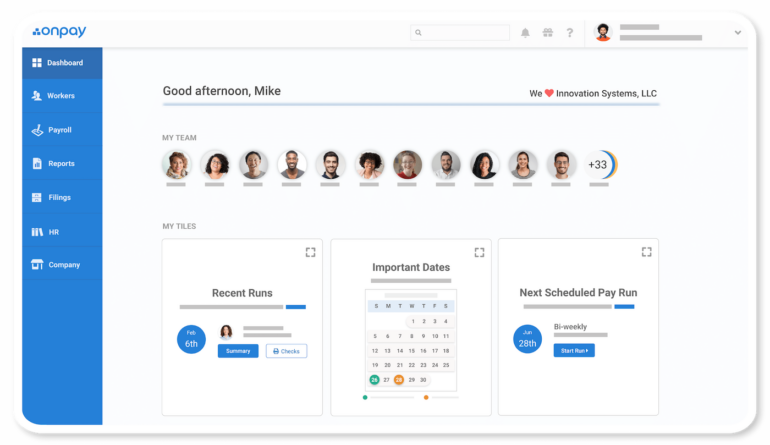

- Most user-friendly ADP alternative: OnPay

- Most HR features: Paychex

- Best for Square users: Square Payroll

Software Spotlight: QuickBooks PayrollSPONSORED QuickBooks Payroll offers versatile, user-friendly payroll solutions tailored to diverse employee needs. |

ADP is a household name in payroll software. However, many small and midsize businesses find the title’s pricing or features excessive. Thankfully, there are abundant alluring alternatives, each tailored to diverse business goals.

Let’s discover some of the other best payroll software available.

Featured Partners

Top payroll software comparison

Every payroll solution targets different needs. Here’s a side-by-side rundown of our top software picks:

| Starting price | International payroll | Human resource functions | PEO services | ||

|---|---|---|---|---|---|

| ADP | Custom | Yes | Yes | Yes | |

| Gusto | $40 + $6 per employee | No | Yes | No | |

| Rippling | $8 per employee | Yes | Add-on | Yes | |

| Papaya Global | $20 per employee | Yes | Limited | Yes | |

| QuickBooks Payroll | $50 + $6 per employee | No | No | No | |

| Paycor | Custom | Yes | Yes | No | |

| OnPay | $40 + $6 per employee | No | Yes | No | |

| Paychex | Custom | Yes | Yes | Yes | |

| Square | $6 per employee | No | Yes | No |

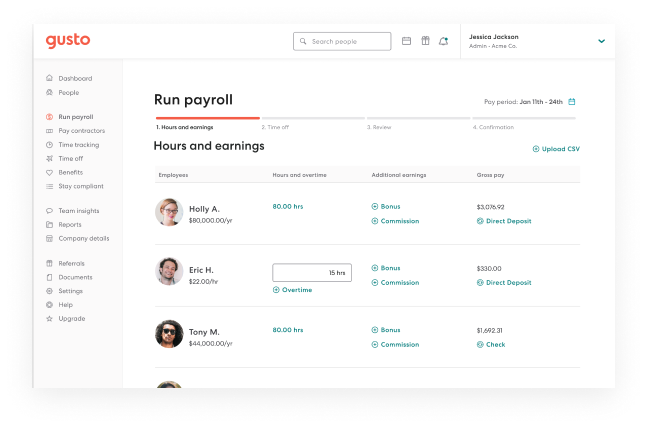

Gusto: Best overall ADP alternative

Gusto is an all-in-one payroll solution with comprehensive features tailored to small businesses. The platform makes cutting paychecks a breeze with transparent pricing, intuitive design and robust perks like automated tax filing.

Perhaps most importantly, Gusto’s pride and joy is its attractive, easy-to-use interface. Anyone can point and click their way around without hassle. This simplicity is the opposite of ADP, which mandates a steep learning curve.

Why we chose Gusto

Gusto’s intuitive look and feel are perfect for small businesses needing efficient payroll processing and well-rounded benefits management. The platform automates crucial tasks like tax filing to keep things easy. It also includes HR tools like onboarding and benefits administration.

For more information, read the full Gusto review.

Pricing

There are three subscription tiers available, plus an independent contractor-only plan:

- Simple: $40 per month plus $6 per employee per month.

- Plus: $80 per month plus $12 per employee per month.

- Premium: Custom pricing.

- Contractor Only: $35 per month plus $6 per person per month.

Get a one-month free discount on your invoice after you subscribe and run your first payroll with Gusto. Other terms and conditions apply.

Features

- Full-service payroll with automated tax filing.

- Gusto Wallet money management app for staff.

- Health insurance and benefits administration.

- Time tracking and PTO management.

- Employee onboarding and HR tools.

- Valuable accounting software integrations.

Pros and cons

| Pros | Cons |

|---|---|

|

|

Rippling: Best for growth

Unlike Gusto, Rippling is built for scalability. You can start with the basics and later tack on accounting, international support in over 160 countries and performance management, among other extensions.

The title is particularly well-suited for technology-centric organizations. That’s because it also provides rich IT management tools. You can keep track of every electronic device and software license in house. Plus, this data syncs with other tools. So, it can automatically issue a new hire a laptop the moment HR inputs their details, for example.

Why we chose Rippling

Rippling is perfect for growing businesses due to its modular structure. Companies can start with payroll and HR, then gradually expand to IT and workforce management.

For more information, read the full Rippling review.

Pricing

- Starting at $8 per employee per month for core functions.

- Additional features at custom pricing.

Features

- Global payroll across 160+ countries.

- Comprehensive benefits administration.

- Time and attendance tracking.

- Employee onboarding and offboarding automation.

- Device and app management.

Pros and cons

| Pros | Cons |

|---|---|

|

|

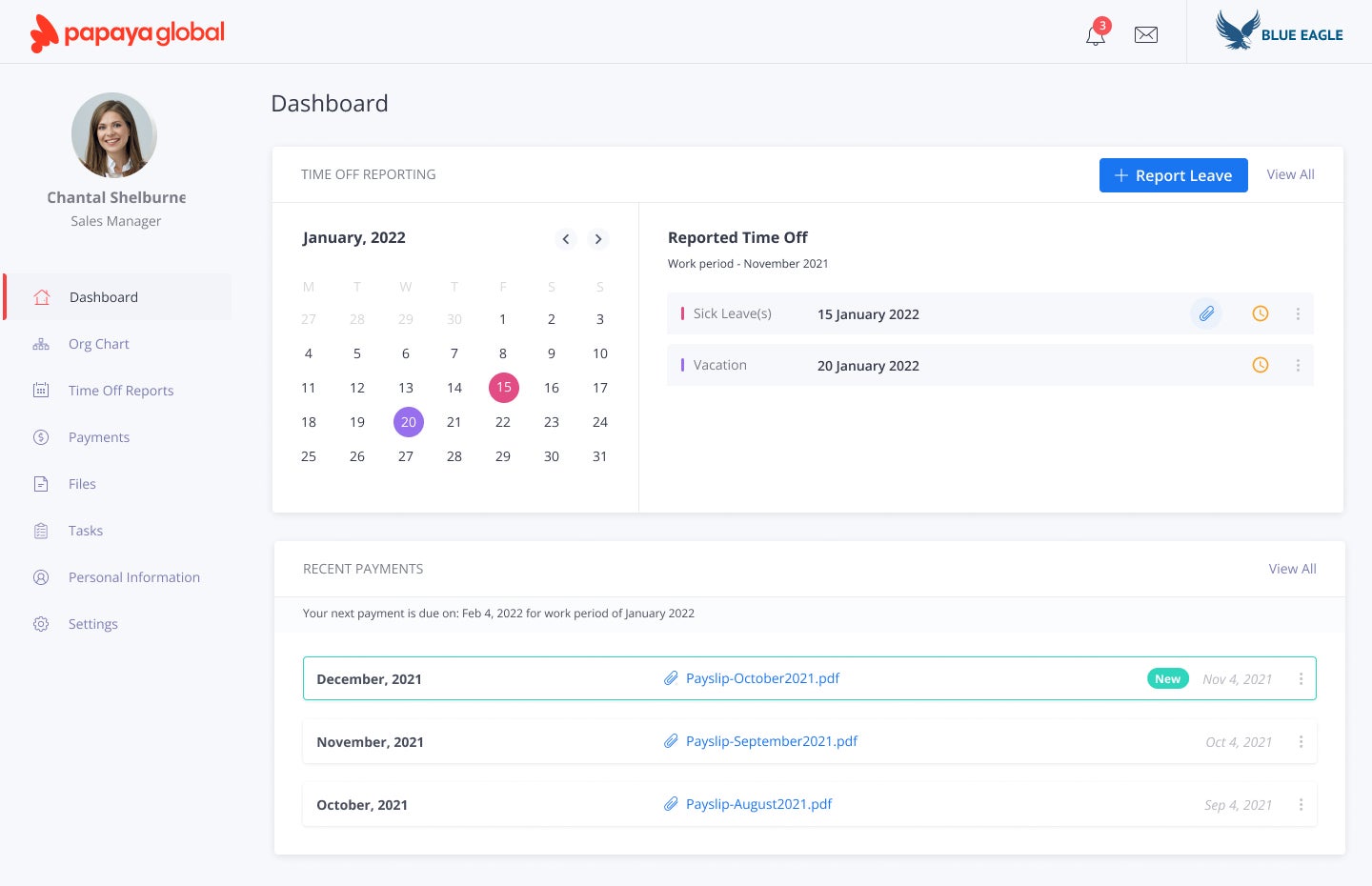

Papaya Global: Best for global payroll

As the name implies, Papaya Global specializes in international payroll. This focus makes it the top choice for companies managing a global workforce.

The title offers payroll services in over 160 countries. Plus, thanks to its rich analytics, you can instantly see a live bird’s eye view of your worldwide operations.

And don’t worry if you have yet to build a team overseas. Papaya Global offers employer of record (EOR) services to handle everything for you.

Why we chose Papaya Global

Papaya Global stands out for its exceptional global payroll services, offering a legally compliant and simplified solution worldwide.

For more information, read the full Papaya Global review.

Pricing

- Grow Global (101–500 employees): $25 per employee per month.

- Scale Global (501–1,000 employees): $20 per employee per month.

- Enterprise Global (1,000+ employees): $15 per employee per month.

- Enterprise Grade EOR: Starts at $599 per employee per month.

- Contractor Payments & Management: Starts $30 per contractor per month.

Features

- Global payroll across 160+ countries.

- Local compliance and tax filing.

- Multi-currency payments.

- Automated workforce management.

- Rich analytics.

Pros and cons

| Pros | Cons |

|---|---|

|

|

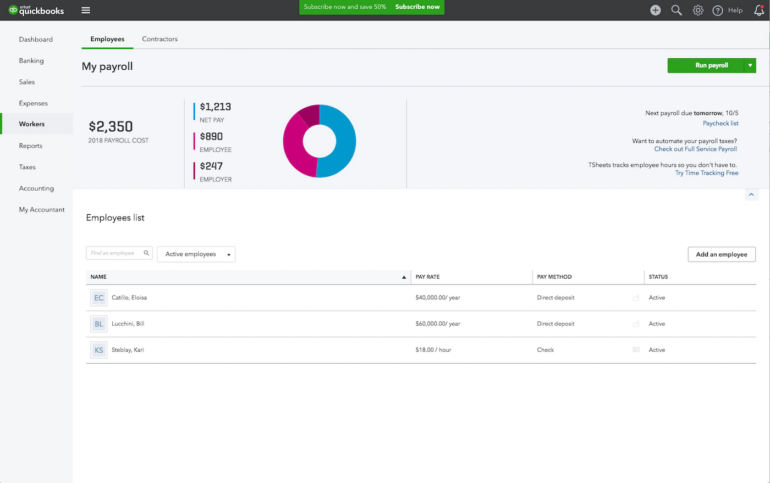

QuickBooks Payroll: Best for QuickBooks users

If you’re an Intuit aficionado, then QuickBooks Payroll is a perfect match. That’s because the title seamlessly integrates with the company’s famous accounting software. In fact, you can purchase a Payroll subscription right inside QuickBooks Online. No need to wrestle with a sales agent or an unfamiliar interface.

Aside from its native connection to other Intuit titles, this ADP alternative is excellent on its own. The title boasts full-service payroll and rich analytics. Plus, your staff will love the complete benefits packages and self-service functions the platform manages.

Why we chose QuickBooks Payroll

QuickBooks Payroll is ideal for existing users of the namesake accounting software thanks to its native integration and simple setup. This link enables businesses to manage finances and payroll on a single platform.

For more information, read the full QuickBooks Payroll review.

Pricing

- Core Plan: $50 per month plus $6 per employee per month.

- Premium Plan: $85 per month plus $9 per employee per month.

- Elite Plan: $130 per month plus $11 per employee per month.

Features

- Automated payroll tax filing.

- Benefits and insurance management.

- Time tracking and project management.

- Extensive support resources.

- Seamless QuickBooks integration.

Pros and cons

| Pros | Cons |

|---|---|

|

|

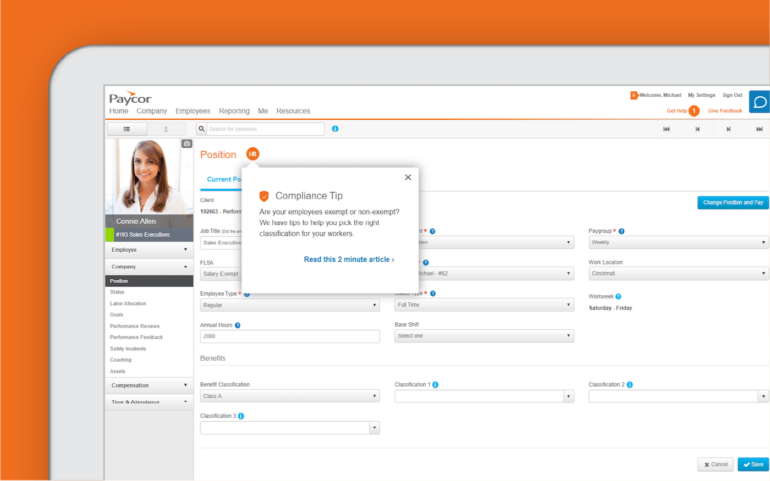

Paycor: Best custom configurations

Paycor is known for its customizable payroll and HR solutions, allowing businesses to tailor the platform to their specific needs.

As a human capital management (HCM) solution, you can choose from a broad array of solutions. These offerings include employee-facing perks, tax compliance consulting and accounting functions, among other non-payroll add-ons. Whereas ADP includes everything and charges accordingly, Paycor focuses more on letting you call the shots.

Why We Chose Paycor

Paycor is ideal for businesses that require a tailored solution, offering flexible configurations and comprehensive payroll management.

For more information, read the full Paycor review.

Pricing

- Custom pricing based on business needs.

Features

- Customizable payroll and HR solutions.

- Automated payroll tax filing and compliance.

- Benefits management and administration.

- Time tracking and scheduling.

- Employee engagement tools.

Pros and cons

| Pros | Cons |

|---|---|

|

|

OnPay: Most user-friendly ADP alternative

OnPay is our top choice for businesses craving user-friendliness without sacrificing functionality in their payroll system. The ADP alternative is prized for its intuitive interface and straightforward setup. It makes managing payroll, benefits and employee records doable without an administrative background.

The platform serves a wide range of industries. This list includes agriculture, food service and nonprofit organizations. So, whether you’re a chef, farmer or something else, you’ll nab a platform that understands your needs.

Why we chose OnPay

OnPay is superb for small businesses seeking a simple, budget-friendly payroll solution that’s still complete with comprehensive features like benefits administration and automated tax filing.

For more information, read the full OnPay review.

Pricing

- Only one simple subscription is available: $40 per month plus $6 per employee per month.

Features

- Full-service payroll with automated tax filings.

- Benefits management and administration.

- Time tracking and scheduling.

- Multi-state payroll compliance.

- Workers’ compensation management.

Pros and cons

| Pros | Cons |

|---|---|

|

|

Paychex: Most HR features

If you need raw administrative power akin to ADP, then Paychex is your best bet. To start, it provides comprehensive payroll and HR services, covering almost every need and situation. You won’t feel underserved, regardless of your business’s stage of growth.

The title goes further with its personalized consulting and outsourced services. You can work one-on-one with a U.S.-based human resources professional to learn how to tackle any concern. And if you need more day-to-day help than resources allow, Paychex’s professional employer organization (PEO) offering can handle tasks for you.

Why we chose Paychex

Paychex stands out for its extensive HR features, covering everything from hiring to firing. Its full-service perks take things to the next level.

For more information, read the full Paychex review.

Pricing

- Custom pricing based on business needs.

Features

- Full-service payroll and tax filing.

- Comprehensive HR tools.

- Robust legal compliance management.

- Employee onboarding and training.

- Benefits management and administration.

- Time tracking and scheduling.

Pros and cons

| Pros | Cons |

|---|---|

|

|

Square Payroll: Best for Square users

Our star rating: 4.2 out of 5

Square Payroll offers complete integration with the Square ecosystem, including Square Team Management. Businesses can access and import timecards from Square POS or the Square Team App to calculate accruals and track PTO balance.

Not only can users import timesheets but also calculate tips and have them ready for the next payroll run. Being able to sync all Square products in one place allows for major visibility into your labor costs and full-scale reporting.

Why we chose Square Payroll

If you’re already using Square’s POS system or time tracking and need a simple payroll platform, it makes sense to consider Square Payroll for that easy integration. The pricing is transparent and there are also optional add-ons such as workers’ compensation, health insurance administration and employee handbook builder. If you’re wanting a more scalable tool or advanced features, ADP continues to be a popular alternative.

For more insight, head over to the full Square Payroll review.

Pricing

Square Payroll offers two plans, a full-service payroll and a contractor-only payroll.

- Contractor-only payroll: $6 per month per person paid. Includes

- Full-service payroll: $35 per month, plus $6 monthly fee per person paid. Includes

Features

- Square Team mobile app.

- HR and compliance notifications.

- Instant deposits.

- Automatic payroll tax calculations and filing.

Pros and cons

| Pros | Cons |

|---|---|

|

|

Do You Need an Alternative to ADP?

Indeed, ADP is highly regarded for its comprehensive payroll and HR services. But some small to midsize businesses might consider alternatives for several reasons:

- Cost effectiveness: ADP’s power comes at a price. Consider how titles like Gusto and OnPay offer transparent, flat-rate pricing, a boon for budget-conscious folks.

- User experience: Many small businesses want to get things done without needing advanced technical expertise. Simple options, like Gusto, are more user-friendly and don’t require any special knowledge.

- Specific business needs: ADP is great for well-rounded coverage, but you may have a niche need. Papaya Global specializes in international payroll, while QuickBooks Payroll integrates seamlessly with QuickBooks — which is perfect for those already using the accounting software.

- Customization and flexibility: Paycor allows extensive customization of its features, catering to specific operational needs better than the one-size-fits-all approach.

- Customer support: Gusto and OnPay are known for their responsive and personalized customer support, which is crucial for smaller businesses without dedicated HR departments.

- Scalability: Alternatives like Rippling offer flexible platforms that scale effortlessly with growing businesses, accommodating rapid expansion smoothly.

- Transparency and hidden costs: ADP is infamous for keeping costs secret. Consider alternatives like Gusto and OnPay, which emphasize transparent pricing without hidden fees.

Methodology

We carefully researched each alternative’s overall value for money, scalability, ease of use, international support and comprehensiveness. We also compared brands to ADP to determine differences and similarities, among other considerations.