It doesn’t seem like it from the consumer’s end, but there’s a lot that goes into a card swipe during a purchase. A colossal infrastructure underpins the financial transactions people make every day. And despite being invisible to the general public, any business that wants to accept payments has to grapple with it in one way or another.

But how are you supposed to sift through processor options, especially when the terminology and fees are so opaque?

While we can’t necessarily prescribe a specific option to a broad, anonymous audience, we know a thing or two about digital B2B solution providers and can help signpost important details and points of interest. So…let’s do that.

Based on our evaluation of 34 processors across 19 data points, the best payment processors are:

- Best overall: Helcim

- Best for high-risk/better approval odds: PaymentCloud

- Best direct processor: Chase

- Best for small businesses: Square

- Best for transparency: Dharma

- Best for growing businesses: Stax

SPONSOREDFlexible payment processing for any business |

Top payment processors comparison

If we were doing a side-by-side comparison of full feature lists, we’d be here until the next fiscal year. We figure you’re probably a busy professional, so the information here up top is abridged and summarized to avoid added details where they aren’t helpful. We’ll dive into deeper details down below, but this table may help you rule out options right away and save you some time.

| Our rating (out of 5) | Monthly fees | POS options | Fastest deposit time | Lowest transaction fee | |

|---|---|---|---|---|---|

| Helcim | 4.66 | None | Yes; proprietary | Within 2 business days | Base interchange, plus 0.15% + $0.06 |

| PaymentCloud | 4.56 | By quote | Yes; 3rd-party | Within 48 hours | 2.4% + $0.10 (rates negotiable) |

| Chase Payment Solutions® | 4.51 | By quote (free options available) | Yes; proprietary | Same-day | 2.6% + $0.10 |

| Square | 4.50 | Starting at $0 | Yes, proprietary | Next business day | 2.6% + $0.10 |

| Dharma | 4.46 | As low as $20/month | Yes; 3rd-party | Next-day | Varies |

| Stax | 4.42 | Starting at $99/month | Yes; 3rd-party | Next business day | 0% + $0.08 |

Limited-time offer: Get $100 off the Chase Point of Sale (POS)SM Terminal. Visit Chase to learn more. Terms and conditions apply.

Helcim: Best overall

Our rating: 4.66

Helcim is our pick for the top all-around competitor in this category. With a cost structure that often achieves the lowest prices in the industry, high customer satisfaction rates and ample add-on options (like POS hardware and payment gateway services), Helcim offers quite a bit of value for the price.

A comparative newcomer to the space, Helcim is a payment processor with the express goal of pricing transparency, lowering barriers to entry for small businesses and helping them to grow and survive. Their cost structure is designed to minimize the fees passed on to their customers, even if that makes the numbers a bit more complex at first glance.

One area where Helcim falls a bit behind its peers in this list is deposit times: they don’t offer any same-day options or even next-day options. They do, however, guarantee “within two business days” across the board.

In short, even if Helcim isn’t a perfect fit for every business, few SMBs would be ill-served by this processor.

Why we chose Helcim

Helcim is a reliable, transparent and affordable option for payment processing. For the vast majority of businesses, Helcim will provide excellent service and pricing that don’t gouge into your profits.

Certain specific outlier use cases may have cause to look elsewhere (and we address several of those below).

Pricing

Helcim does not charge monthly subscription fees, and doesn’t have contracts. Instead, you only pay the transaction fees.

For every transaction, they pass along the lowest available interchange fee, and add their margin on top, with scaling discounts for higher volumes. This pricing model is known as “interchange plus.” At the highest volumes, you can see rates as low as:

- In-person—base interchange fee, plus 0.15% + $0.06

- Keyed and online—base interchange fee, plus 0.15% + $0.15

Rather than flattening the fee to be the same regardless of the interchange cost, like processors such as Square do, Helcim keeps the same margin on their end for every fee, so lower interchange rates lead to lower costs for you.

Features

- “Interchange Plus” pricing helps businesses keep more of what they earn.

- Discounts on transaction fees for high-volume customers.

- Integrates with popular financial apps like QuickBooks and Xero.

- No contracts, no commitments, no hidden costs for walking away.

- Optional surcharging features that allow you to pass transaction fees on to customers.

Pros and cons

| Pros | Cons |

|---|---|

|

|

PaymentCloud: Best for high-risk/better approval odds

Our rating: 4.56

Just as consumers with lower credit scores might have to work harder to get an auto loan, some businesses also struggle to get approval for things like merchant accounts. It may even be for no reason other than the nature of the business itself — such as with high-risk categories like age-restricted products.

Without a merchant account, though, there’s no way to process payments electronically, and you’re stuck having to take every transaction in cash.

PaymentCloud is our leading pick for businesses that face issues like this. A processor with more favorable approval rates, they have options to help businesses that have been turned down elsewhere. And their processing fees are negotiable.

Their less transparent public-facing pricing can be a bit frustrating, and approval timeframes are often longer due to the nature of the underwriting being done. But for businesses that struggle to get approved by other processors, a longer wait time may be a very tolerable price of admission.

Why we chose PaymentCloud

PaymentCloud is among the few payment processors that provide options to businesses underserved by the bulk of the market. Case in point: our top overall pick — Helcim — flat out can’t approve certain business types, making all of their other benefits moot.

Sometimes, what you need is a reputable, reliable partner that will actually give you a chance.

Pricing

PaymentCloud doesn’t publicly list its subscription costs or transaction fees. You’ll have to contact the sales team for any up-to-date or fully accurate information there. That being said, some user reviews have reported per-transaction rates as low as 2.4% + $0.10 in some cases, and they are negotiable.

Features

- Better approval odds for businesses that can’t get merchant accounts with other processors.

- Compatible with a variety of 3rd-party hardware, including the popular Clover systems, which can be purchased directly from PaymentCloud

- Integrates directly into a host of digital shopping carts, online stores and other ecommerce tools.

- Negotiable processing fees.

- Surcharging tools that allow you to pass processing fees on to customers.

Pros and cons

| Pros | Cons |

|---|---|

|

|

Chase: Best direct processor

Our rating: 4.56

This one is for all of you out there thinking, “it’s all electronic; why isn’t it instant?”

There are a host of reasons — some more understandable than others — why so many processors don’t guarantee same-day deposits. If that’s a major drawback for you, there are a few ways you can close the gap, and make it easier to get your money faster. The simplest is this: use the same organization as your processor, and your banking institution.

That’s where Chase fits into this list. Widely recognized as a leading national bank, Chase also offers payment processing. That means you can set up a business bank account with Chase and have them handle the processing of your transactions. The major upside to this is Chase’s guarantee for same-day availability of funds when it’s going into an account they handle.

Why we chose Chase Payment Solutions®

Look, we can’t fault you for wanting your money faster. No one really likes waiting to get paid, after all. So when it happens that Chase is a reputable bank, and a solid contender as a payment processor, it’s not a huge leap to decide to use them for both purposes.

In addition to fast funding, Chase also offers excellent account stability, security and competitive, negotiable rates.

Pricing

Chase breaks their fee structure into three sections:

- Tap/dip/swipe—2.6% + $0.10 per transaction

- Keyed-in/payment links—3.5% + $0.10 per transaction

- Ecommerce—2.9% + $0.25 per transaction

Customized pricing, such as interchange plus, is also available upon request.

Additionally, Chase offers some extra benefits and perks if you’re using their banking system. For example, you can benefit from their same-day funding at no additional cost, if you’re having them deposit incoming customer payments into a Chase business account.

Features

- Few processors offer deposits as fast as Chase’s (let alone faster).

- Option to use Chase for business banking as well as payment processing.

- Widely compatible with numerous ecommerce solutions.

- A host of POS hardware options, many of which integrate directly into your bank account.

- Proprietary business analytics platform at no additional cost that offers demographic, purchasing and competitor insights across all Chase card and bank transactions.

Pros and cons

| Pros | Cons |

|---|---|

|

|

Square: Best for small businesses

Our rating: 4.50

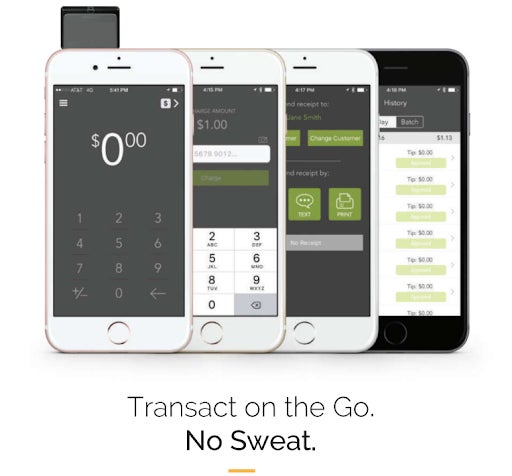

Another financial brand with a strong presence elsewhere in the digital ecosystem, Square initially made a name for itself with its flagship mobile-enabled card reader. That same design philosophy and market focus guide Square to this day, with much of its offerings prioritizing the needs of small businesses, including those without a physical location or online store.

And, like Chase, one of the big advantages of using Square is how it combines two different links in the processing chain — in this case, the processor and the POS equipment. As such, it’s easy to get started (you can sign up for free and only pay processing fees), simple to implement and a breeze to use.

Related: Point of Sale Deployment Checklist

Why we chose Square

Square is our pick for small businesses because of how it dramatically lowers the barrier to entry, even for pros just starting out. It’s incredibly common for new businesses to come to Square for their POS hardware and ultimately decide to stay for the payment processing. It’s hard to argue with the extreme convenience and the transparency of the pricing model.

Pricing

You can sign up for Square for free, and many use it this way, paying only for transaction fees. There are paid subscription options, however:

- Free—$0 per month; just pay the processing fees.

- Plus—Starting at $29 per month, adds features tailored to the needs of food service, retail and appointment-based businesses.

- Premium—custom plans, with custom pricing.

As for the processing fees, Square breaks down transactions into four different categories, each with a different price point:

- In-person—starting at 2.6% + $0.10 per transaction

- Online—starting at 2.9% + $0.30 per transaction

- Invoices—starting at 3.3% + $0.30 per transaction

- Manually entered—starting at 3.5% + $0.15 per transaction

Custom rates are also available for businesses processing more than $250,000 monthly.

Features

- POS provider and payment processor in one.

- Use for free, without monthly subscription and pay only for the processing you actually have them do.

- Convenient technology that integrates easily with the majority of platforms, mobile devices and other tools of the trade.

Pros and cons

| Pros | Cons |

|---|---|

|

|

Dharma: Best for transparency

Our rating: 4.46

A California-based company focused heavily on giving back to the community via donations and supporting non-profits, Dharma is an organization equally concerned with its impact on the businesses it serves and society at large. All “about us” page details aside, Dharma holds the prestigious position of having both the most complex and the most transparent pricing on our list.

In all fairness, there’s plenty of complexity to be had with the many interlinking chains of digital finances and commerce. That means there’s plenty of room to hide fees, upcharges and other nasty surprises in there under the guise of “simple” or “straightforward” pricing.

Dharma gets ahead of that. It takes a little reading to get a firm grasp of how their structure works, and it may be worthwhile to talk to their staff directly. But for those willing to do the math and check their numbers, you’ll find it all adds up correctly.

Why we chose Dharma

In an economic environment like the one we live in today, few betrayals feel as complete as when business “partners” take our hard-earned profits right out of our digital wallets, so to speak.

Dharma makes our list both because they’re a respectable payment processor and because there are no dark patterns or opaque systems at play. It may take more detailed calculations to check their math, but they provide all the figures necessary to do so, and you’ll be unlikely to ever need to question charges on the bill as a result.

Pricing

Dharma doesn’t have a quick-and-easy breakdown of its pricing on its website. However, they do clearly state that there are no hidden fees, no contracts and that they almost always come out to a price point cheaper than other providers.

Rather than leave that last point as an ambiguous brag that can’t be verified, they have cost calculators on their site that allow you to compare Dharma’s pricing to that of its competitors.

The fee structure breaks down into three sections:

- Monthly fees (ranging from $20 to $25, with discounts for higher volumes).

- Volume fees (ranging from 0.10% of volume to 0.15% of volume, with discounts for higher volumes).

- Transaction fees (as low as $0.08 per transaction, depending on account/processing type).

For a clear, accurate idea of what you’ll be paying, you’re better served by checking out the calculators yourself. As a bonus, you’ll be able to compare them against the cost structures of its competitors, like they intended.

Features

- Despite complexity, Dharma boasts the highest pricing transparency of any provider on our list.

- Hardware-agnostic, you can buy just about any POS system and use it with Dharma.

- Once you’ve fully understood the numbers, Dharma’s rates are among the most competitive and favorable.

Pros and cons

| Pros | Cons |

|---|---|

|

|

Stax: Best for growing businesses

Our rating: 4.42

A big question on the minds of many ambitious entrepreneurs is, “will this support my business as it scales?”

Stax is our pick for a processor that answers that question in the affirmative. With a flat monthly subscription model, businesses are heavily incentivized and rewarded for processing at higher volumes.

Rather than tack on a percentage fee as its profit margin, Stax charges you the base interchange fees (which are mandatory), a flat markup of less than 15 cents per transaction and then a monthly subscription fee based on the processing volume. As a result, many businesses wind up paying significantly less, since Stax’s profit margins are capped.

And as volume goes up, the average cost per transaction goes down, saving you even more the more you use their service.

Why we chose Stax

So much of minimizing processing costs comes down to keeping the processor from taking more than their fair share. Stax approaches this from an interesting angle by way of a flat monthly fee. That fee goes up as volume does, but often works out to a lower cost per transaction.

In other words, if you’re already processing a decent amount, or expect to see extensive growth in the near future, you stand to save quite a bit by using Stax.

Pricing

Stax does not charge per-transaction markups, instead breaking their fees into brackets based on volume.

- Processing up to $150,000 annually—$99/month, plus interchange fees

- Processing up to $250,000 annually—$139/month, plus interchange fees

- Processing more than $250,000 annually—$199/month, plus interchange fees

For each transaction, Stax charges a flat-rate fee, typically ranging from 5 – 15 cents, depending on your plan and whether the transaction is card-present or card-not-present.

Custom pricing is available for high-volume clients

Features

- Uniquely suited to facilitating growth and high-volume clients stand to save significantly more through their pricing structure.

- Add-on features include custom branding, automated billing and payments, and integrated SaaS platform payments.

- Boasts industry-leading compliance.

Pros and cons

| Pros | Cons |

|---|---|

|

|

How do I choose the best payment processor for my business?

We did our very best, but obviously, there’s no way to consider the full breadth of possible business needs when doing a list like this. Every business is different, and has different needs, so you’ll ultimately have to apply some level of discretion when considering our picks in the list.

That being said, we looked at our candidates and considered them through the lenses below, to ensure that we focused on the factors most commonly prioritized across the infinite number of use cases in the market.

Pricing, costs and transparency

Fee structures can become frustratingly complex in some B2B scenarios, and payment processors aren’t an exception. Transaction fees are the foundation of the cost matrix here, and interchange fees make up the majority in many cases. Additionally, there are added processing fees, as well as potential costs like monthly subscriptions, hardware payments for POS terminals and more.

Depending on the solution in question, you may be able to achieve lower overall costs by bundling offerings from the provider, prioritizing lower interchange fee transactions, increasing processing volume and so forth.

Beyond that, some brands are better than others at being upfront with their pricing, complex or otherwise. Even a convoluted fee structure can be made tolerable if there are no surprises on the bill at the end. Conversely, brands that try to obscure and hide costs until you get the final invoice can be infuriating, especially when it seemed so straightforward initially.

Oh, and don’t forget that contracts can still gum up the works here, like they do elsewhere in business. Some brands offer month-to-month service, allowing you to cancel anytime. Others will require you to commit yourself to a contract (which can be up to three years long or more).

There’s no “correct” answer in all of this; it comes down to how the scales balance out. What serves as a dealbreaker for one organization may be a tolerable price of admission for another, depending on the “pros” in that scenario. Just don’t go into any of this blind, and expect opaqueness by default until proven otherwise.

Security, stability and reliability

You’re dealing with electronic financials. Each transaction involves sensitive information and the transference of currency. The last thing you need is to use a channel you believe to be secure, only to leak priceless information and hard-won revenue out into the hands of bad actors.

Data breaches are a little like car accidents — they seem distant and borderline imaginary until they happen to us personally. But the past decade has proven that no organization, no matter how large or tech-savvy, is immune to attacks and vulnerabilities. So don’t be afraid to play hardball and investigate heavily when vetting the leading contenders on your list.

Equally important is how dependable the system is. These are all internet-dependent interactions, so if the system is down, you effectively can’t get paid. Errors, failed batching and other issues can also create problems, leading to unwelcome surprises for your customers and chaotic financial cleanup for you.

Keep an eye out for things like uptime guarantees (and reviews that prove or disprove them) to help avoid dealing with more of these issues than strictly required. And remember, 99.9% uptime may sound like a lot, but that still leaves over a full eight-hour workday’s worth of downtime over the course of a year.

Compatibility and flexibility

There are so many moving parts in the processing chain. POS systems, payment gateways, banking networks, digital storefronts, web hosts — the list goes on and on. If you have the freedom to simply jump straight in with a payment processor’s all-in-one solutions, great.

If, however, you have tools you are currently using or need to use, double and triple check the compatibility before you commit to anything.

Speed, delays and turnaround time

Nobody likes waiting to get paid. Nobody likes waiting to get assistance when they have an issue. And, no one likes having to pause sales because the system is down and you can’t get ahold of a live helpline.

From deposit speed, to customer service quality, there are quite a few ways a payment processor can accelerate things on your end, or slow them to a crawl. You won’t always find concrete figures on things like this, and sometimes you’ll have to look elsewhere to find them (like reviews and 3rd parties). But you’ll prefer the legwork to the unpleasant surprises on the other end.

Use case considerations

Payment processors aren’t prone to the same degree of use case sensitivity as other parts of this chain (like POS systems, for example). Still, you may have special considerations or specific needs you prioritize that may be nominal concerns to other businesses, such as integrations with a specific software, or handling a specific payment type like text links.

In this list alone, we point to concerns like high-risk retail, processor/banking combos and scalability. You’re not being unreasonable by searching for specific features or functionality. You’re being thorough and strategic.

Methodology

For this list of payment processing providers (say that ten times fast), we built a list of the most popular candidates with positive reputations and user reviews. Then, we reviewed candidates based on a number of critical core factors, including cost, pricing transparency, contract terms, security and stability, compatibility and integrations, and how chargebacks were handled.

To gather information, we consulted the processors themselves, tested hands-on demos and free trials, and solicited feedback/reviews from current and past users. We paid particular attention to areas of functionality that were non-standard, if they were mentioned in the brand’s marketing as an available feature, and whether or not reviews indicated it worked as described.

There’s no getting around the need for a payment processor, but we hope our efforts here have been useful in helping you sidestep any unnecessary costs regarding which vendors you research or choose to use.

This article and methodology was reviewed by our retail expert Meaghan Brophy.