Especially for solopreneurs and small businesses, affordable invoicing apps are essential to keeping on top of billing and receiving payments. The right invoicing app can make it easy and cost-effective to bill for work done and receive payments from customers on time.

SEE: Payroll processing checklist (TechRepublic Premium)

These four affordable invoicing apps for small businesses or self-employed individuals can make it easier to get paid faster. In this guide, we’ll walk you through each product, its key features, pros and cons, and how much it costs to get the app up and running.

Featured Partners

Invoicing apps for small businesses: Comparison table

| Number of users | Integrations | Invoice payment | Phone support | Mobile app | |

|---|---|---|---|---|---|

| QuickBooks | Advanced version supports 10 users | Over 600 | Yes | Yes | Yes |

| FreshBooks | 1 user. Additional user is $11 | Over 80 | Yes | Yes | Yes |

| Zoho | Unlimited | Over 500 | Requires integration | Yes | Yes |

| Xero | Unlimited | Over 1000 | Requires integration | No | Yes |

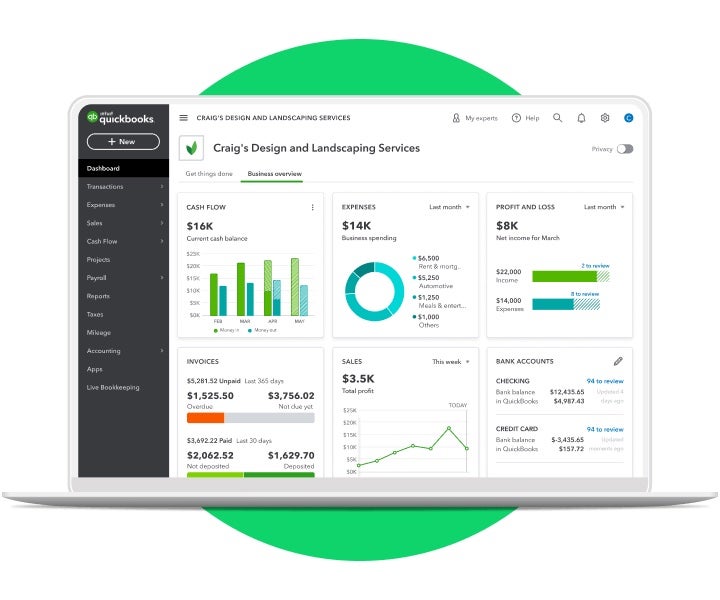

QuickBooks

QuickBooks Online by Intuit is accounting software for solopreneurs and small businesses that helps them better manage the processes involved in invoicing, receiving payments and running financial reports. Business owners have instant access to customer, vendor and employee information from their online portal.

Key features

- Create customizable, branded invoices with modern templates

- Automated setup and sending for recurring invoices

- Automatic matching between payments and invoices

- Mobile-friendly approach to invoicing, receiving payments and other tasks

Pros

- Accessible user interface

- Several automation features

- Extensive troubleshooting resources

Cons

- Payment processing is difficult

- Missing some advanced features, including industry-specific tools

Pricing

QuickBooks Online has three four pricing plans for small business users:

- Simple Start: $30/mo.

- Essential: $60/mo.

- Plus: $90/mo.

- Advanced: $200/mo.

It’s important to note that QuickBooks frequently offers discounted pricing. For example, it is currently offering a deal of 50% off for three months on each of these plans if you buy now.

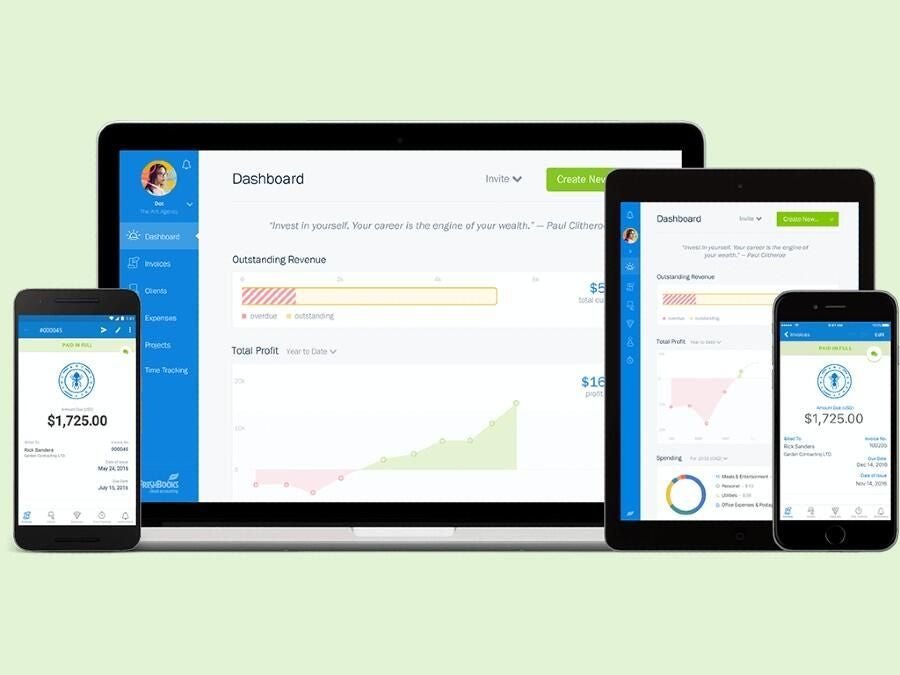

FreshBooks

FreshBooks is an affordable invoicing and accounting solution that helps individuals and small companies easily create customizable and professional-looking invoices. Invoices can be sent by email, billable time can be effortlessly tracked, and payments can be collected online using credit cards and ACH deposits. Freshbooks is available on iOS and Android devices.

Key features

- Invoice generator to simplify adding tracked time and expenses on the go

- Different pricing options, including fixed pricing for easier and more stable cash flow forecasting

- Workflow management for recurring invoicing, time tracking and project management

- Instant updates to see when invoices are viewed and paid

Pros

- Easy to use for freelancers and very small businesses

- Excellent customer service, including extended phone support hours

Cons

- Missing tools for larger businesses

- Limited customization

Pricing

Four monthly plans are available:

- Lite: $19 per month

- Plus: $33 per month

- Premium: $60 per month

- Select: Custom pricing and plans

Discounts are available for buyers who choose the annual payment plan. The Lite, Plus and Premium plans each come with a free trial option. In addition, FreshBooks often offers discounts and deals. For example, each of its plans is currently 70% off the normal price for three months.

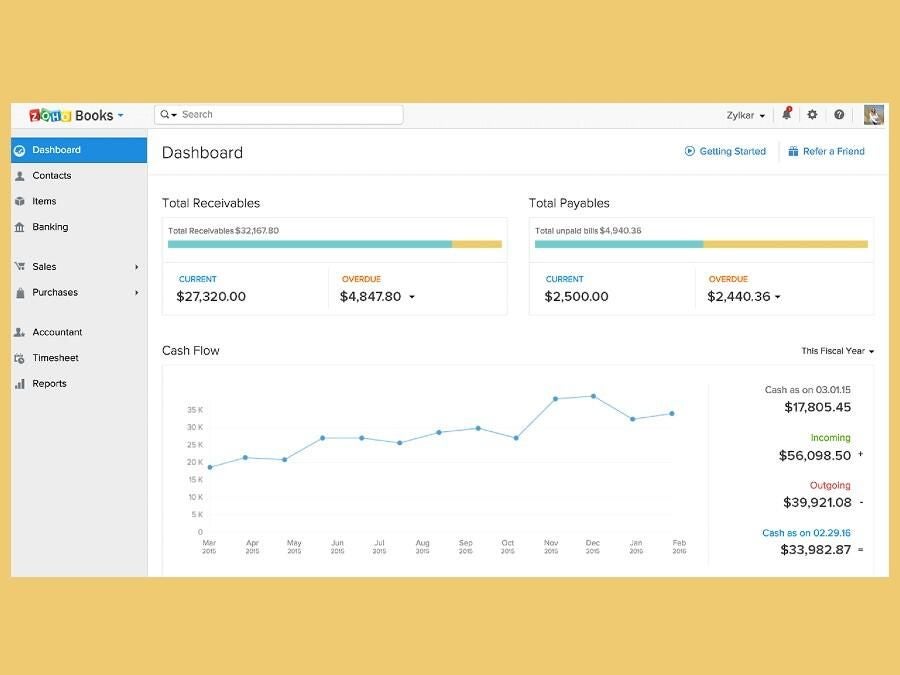

Zoho Books

Zoho Books is invoicing and accounting software for small businesses that makes invoicing and managing accounts receivable simple. Companies can customize invoices and statements to meet their customers’ needs and receive payments in multiple currencies. Available on iOS and Android, Zoho Books helps businesses track time, collaborate with customers and get paid online faster.

Key features

- Quote sharing with clients to speed up estimate approvals

- Multiple payment options for clients: Cash, check and online payments

- Auto-charge for recurring transactions and auto-collection for payments

- Estimate conversion into sales orders and invoiced orders

Pros

- Free version available

- Excellent reporting

- Extensive customizability

Cons

- No integration with Zoho Inventory

- Steep learning curve for advanced functions

- Not the best user interface

Pricing

Zoho Books comes in six different pricing plans:

- Free: $0, recommended for businesses with revenue less than $50,000 per year

- Standard: $15 per organization per month

- Professional: $40 per organization per month

- Premium: $60 per organization per month

- Elite: $120 per organization per month

- Ultimate: $240 per organization per month

Zoho also offers annual payment options at lower rates.

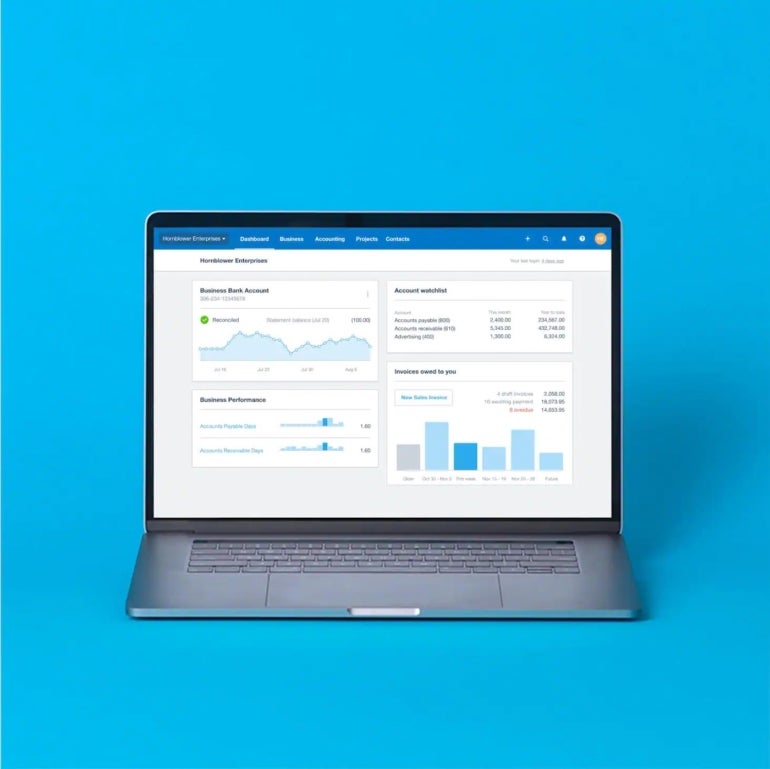

Xero

Xero is all-in-one accounting software that allows entrepreneurs and businesses to do everything they need to run their business. It is specifically helpful for keeping records organized and tidy and simplifying compliance management.

Xero connects you with 800 third-party apps to make running a business more manageable. It is available on iOS and Android devices, so business owners can take care of invoicing and other tasks whenever and wherever.

Key features

- Customizable invoice layouts with the ability to add more fields and adjust logos, payment terms and standard messaging

- Online payments can be accepted using a Pay Now button on invoices or third-party payment portals

- Ability to see when customers have viewed an invoice

Pros

- Extensive third-party app integrations, including with Gusto payroll

- Easy to use

- All plans support unlimited users

- Excellent mobile app

Cons

- No dedicated customer support phone number

- Entry-level plans have limits on bills and invoices

Pricing

Xero has three monthly plans:

- Early: $20 per month

- Growing: $47 per month

- Established: $80 per month

A free trial is also available for interested buyers.

What should you look for in invoicing apps?

Integrations

Some apps can handle all of your invoicing and accounting needs; however, some require integration with third-party apps. You should check if the invoicing app you’re interested in integrates with your existing tech stack to ensure a smooth introduction of the new invoicing software to your business.

If your current tech stack does not integrate or there are some compatibility issues, you might need to evaluate other options.

Customization

The invoicing app you select should be customizable enough for you to format invoices and other processes according to your needs. The ability to customize, for example, helps project an accurate visual representation of your company on the invoice with a company logo and other white-labeling features.

Invoice app customization features can also give you the ability to create and save different types of invoices for different customers, without requiring you to manually modify invoices every time.

Scalability

Ideally, you want to invest in an invoicing app that will allow you to scale your business up or down without needing to change the software. Growth in the business will more than likely lead to increases in invoice and transaction volume and complexity.

Whether or not you plan to make changes to your headcount, it’s always best to have the flexibility to scale up and down. Typically, an app with unlimited users or tiered pricing models offers better scalability.

Customer support

Whether you need technical support for initial configuration or when you run into problems down the road, having solid customer support from the vendor is essential. An advantage of working with widely-used software solutions, such as QuickBooks, is that you get several online resources, such as forums and articles in addition to traditional customer support and troubleshooting.

Mobile and web app compatibility

The invoicing solution you choose should offer mobile and web app interfaces, so users can access invoicing tools from any device, anywhere. Look for an invoicing solution with a strong mobile user interface that can handle information processing and retrieval in real time.

Benefits of using invoicing apps for your small business

Using an invoicing app offers great value for money, as it helps streamline several business processes. With the right app, you can automate some of the steps involved in invoicing to maximize efficiency, especially when you need to send multiple invoices at once. Invoicing apps also help improve the monitoring of company expenses and reduce the chances for human error.

SEE: Hiring kit: IT finance manager/budget director (TechRepublic Premium)

The tracking features that many invoicing apps have allow you to see the clients who pay you on time and who are lagging. This extended visibility and improved efficiency in creating and sending invoices can improve cash flow, which is extremely important for freelancers, solopreneurs and small businesses.

In addition, using invoicing apps will give your company a professional look, with white-labeling, templates and other tools to help standardize the invoice format. Finally, invoicing apps can make for easier auditing by simplifying data retrieval and report generation.

Read next: Top payroll processing services for small businesses (TechRepublic)