- Best overall nonprofit payroll: Gusto

- Best payroll tax compliance support: Paychex

- Most payroll flexibility: Rippling

- Best value for price: OnPay

- Most affordable software: SurePayroll by Paychex

- Best PEO solution: Justworks

- Best QuickBooks Online integration: QuickBooks Payroll

Nonprofit organizations play a unique and crucial role in society. But just like any organization, 501(c)(3) organizations still need to pay their employees, calculate and remit payroll taxes and budget for payroll costs.

Gusto is the best nonprofit payroll service for most organizations. Its Aplos and MonkeyPod integrations simplify nonprofit financial management, and its extremely user-friendly platform automates the most time-consuming, confusing parts of processing payroll.

This article compares the best payroll services for nonprofits in 2024 to help you choose the one that fits your organization’s needs and budget.

Featured Partners

| Vendor | Starting base price | Starting per-payee price | Top nonprofit integrations | Our star rating | Learn more |

|---|---|---|---|---|---|

| Gusto | $40/mo. | $6/payee/mo. | Aplos, MonkeyPod | 4.6 out of 5 | Try Gusto |

| Paychex | $39/mo. | $5/payee/mo. | Uncommon Giving | 4 out of 5 | Try Paychex |

| Rippling | Custom | $8/payee/mo. | Bright Funds | 4.3 out of 5 | Try Rippling |

| OnPay | $40/mo. | $6/payee/mo. | Accounting software | 4.7 out of 5 | Try OnPay |

| SurePayroll by Paychex | $19.99/mo. | $4/payee/mo. | Accounting software | 4.7 out of 5 | Try SurePayroll by Paychex |

| Justworks | None | $59/payee/mo. | Accounting software | 4.2 out of 5 | Try Justworks |

| QuickBooks Payroll | $50/mo. | $6/payee/mo. | QuickBooks Online | 4.1 out of 5 | Try QuickBooks |

Plan details up to date as of 1/29/2024.

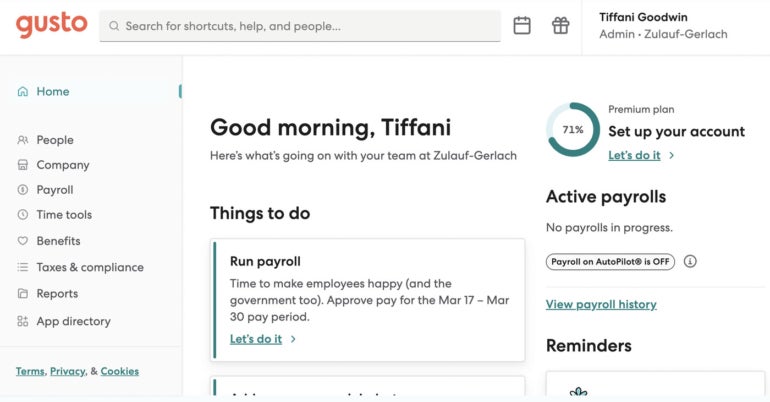

Gusto: Best overall nonprofit payroll

Our star rating: 4.6 out of 5

Gusto is one of the best payroll software services for small businesses, large corporations and nonprofits alike. For one thing, the software is extremely accessible. Whether you have a lot of practice paying employees or your organization just hired its first W-2 employee, it won’t take you long to get the hang of processing payroll with Gusto.

Just how simple is Gusto for nonprofits? The main thing you have to do is enter your employees’ pay information. From there, you can set payroll to run automatically. Gusto will pay your employees on a pre-set pay schedule via direct deposit, calculate and deduct payroll taxes, and remit those taxes to the government on your behalf.

Why we chose it: Frankly, it’s hard to find nonprofit payroll software more convenient, intuitive and user-friendly than Gusto. If you’re anxious about processing payroll accurately, Gusto is the perfect software to start with.

Figure A

Plus, as one of the most popular payroll providers in the United States, Gusto syncs with nonprofit-friendly business software, including accounting programs and nonprofit-specific software like Aplos and MonkeyPod.

Our Gusto review can tell you more.

Pricing

Gusto lists pricing for three of its plans online:

- Contractor Only: $6/contractor/month for six months, then $35/month + $6/contractor/month.

- Gusto Simple: $40/month + $6/contractor or employee/month.

- Gusto Plus: $80/month + $12/contractor or employee/month.

Gusto also has an enterprise-level payroll plan, Gusto Premium, available for custom pricing only.

While Gusto doesn’t advertise a free trial, new users can set up an account for free. You won’t pay a cent unless and until you decide to run payroll.

Get a one-month free discount on your invoice after you subscribe and run your first payroll with Gusto. Other terms and conditions apply.

Top nonprofit payroll features

- Aplos and MonkeyPod integrations + dozens of other third-party software integrations.

- Optional health insurance and retirement plan benefits through Gusto’s brokerage.

- Built-in benefits administration.

- International contractor payment add-on for global organizations.

- Employee-friendly features like self-service onboarding, financial benefits and insurance enrollment.

Pros and cons

| Gusto pros | Gusto cons |

|---|---|

|

|

Paychex: Best payroll tax compliance support

Our star rating: 4 out of 5

Paychex is one of the top payroll providers worldwide. Its software has a higher learning curve than Gusto, but it’s also equipped with more customizable reports and a much bigger HR library. Paychex Flex also gives you many options for paying your employees, including via direct deposit, paycard, paper checks and on-demand payment apps.

Why we chose it: Paychex’s nonprofit payroll software solution caters to small and midsize businesses as well as to nonprofits of all sizes. Its platform simplifies financial activities such as tracking donations, filing taxes and recording expenditures for nonprofits.

In contrast to Gusto, which only issues compliance alerts with its highest-tier plan, Paychex keeps you on top of potential tax compliance issues with frequent alerts and useful reporting.

Our Paychex review can tell you more.

Pricing

Base pricing for Paychex Flex Essentials starts at $39 per month + $5 per employee per month. Paychex’s two other nonprofit payroll software plans require custom quotes.

While Paychex’s starting price is lower than the average, bear in mind that Paychex charges extra for a variety of essential services, including tax form W-2 and 1099 generation, wage garnishment, general ledger integration and state unemployment insurance administration.

As a result, Paychex is probably too expensive for the smallest nonprofits. It’s a better choice for midsize, growing and larger nonprofits, including those with an international presence.

SEE: Why Does My Business Need a Payroll Service? (TechRepublic)

Top nonprofit payroll features

- Standout reporting features, including nonprofit-specific reports.

- Hundreds of integrations, including with nonprofit apps like Uncommon Giving.

- HR library access with two higher-tier plans.

- Tax compliance support.

- Fast direct deposit.

Pros and cons

| Paychex pros | Paychex cons |

|---|---|

|

|

Rippling: Most payroll flexibility

Our star rating: 4.3 out of 5

Rippling is a domestic and global HR and payroll platform for both for-profit and nonprofit organizations. From tax deductions, PTO and 401(k) calculations to HSA or FSA deductions — along with filing payroll taxes across all 50 states and internationally — Rippling takes care of compliance activities for you.

Crucially for nonprofits, Rippling lets users customize dozens of prebuilt reports. From the payroll dashboards, you can see, analyze and share these reports across different teams and departments for seamless decision making.

Why we chose it: Rippling’s interface was built with a minimalist, user-first design, meaning Rippling offers nonprofits a payroll system they can set up and start using without difficulty.

Additionally, unique among the nonprofit payroll services on our list, Rippling is modular. Organizations that use Rippling can build their own HR, payroll, IT and financial plans from the ground up. It’s easy to start off using Rippling payroll when yours is a small one- or two-employee organization, and it’s just as easy to scale up in features as your nonprofit expands to reach even more individuals.

Learn more by reading our Rippling review.

Pricing

Each Rippling plan costs a custom monthly base fee. On top of that fee, you’ll pay $8 per person paid per month for Rippling payroll. Each additional module costs another per-employee fee per month.

Top nonprofit payroll features

- Over 500 third-party software integrations.

- Unified employee database for managing employee data automatically across all modules.

- Managing and filing payroll taxes across the U.S. + optional global payroll capability.

- Local currency payments for global contractors and employees.

Pros and cons

| Rippling pros | Rippling cons |

|---|---|

|

|

OnPay: Best value for price

Our star rating: 4.7 out of 5

OnPay is at least as user-friendly as Gusto, if not more so. OnPay’s team of professionals will set up your payroll software for you at no cost, and the payroll company’s excellent customer service team is available at extended hours to ensure you can resolve any payroll problems quickly and easily.

Why we chose it: OnPay has fewer fees and hidden costs than just about any nonprofit payroll service on our list. You don’t pay extra for just about anything, including wage garnishment, W-2 and 1099 form generation, accounting software integration and multi-state tax filing — all payroll features that most other services charge extra for.

OnPay brings the same low-cost, high-value mentality to its nonprofit features as well. For instance, unlike Paychex, which charges extra for federal and state unemployment tax administration, OnPay helps nonprofits manage FUTA exemptions for 501(c)(3) organizations at no extra charge.

Learn more by reading our OnPay review.

Pricing

OnPay has just one plan that costs $40 per month plus $6 per employee paid per month. Every organization that uses OnPay gets the same nonprofit payroll features. There are no hidden fees, and the only price difference is determined by the number of people you pay.

Top nonprofit payroll features

- Automatic tax administration.

- Optional employee benefits in all 50 states.

- Built-in, fee-free benefits administration.

- Accounting and time-tracking software integrations.

- Manages FUTA exemptions for 501(c)(3) organizations.

Pros and cons

| OnPay pros | OnPay cons |

|---|---|

|

|

SurePayroll by Paychex: Most affordable software

Our star rating: 4.7 out of 5

If affordability is your top payroll consideration, we can’t recommend SurePayroll by Paychex highly enough. Its self-service plan puts payroll taxes in your hands, meaning the software calculates payroll taxes but you take responsibility for remitting those taxes to the federal and state governments. For just $10 more a month, SurePayroll by Paychex will remit taxes on your behalf.

Whichever plan you choose, you’ll get a slew of time-saving automations that help you spend minimal time on payroll processing.

Why we chose it: Both SurePayroll by Paychex’s self-service and full-service options are among the cheapest payroll plans on the market. That said, SurePayroll by Paychex doesn’t sacrifice features and quality for the sake of price. Using SurePayroll by Paychex will ensure your employees can access top-notch benefits without requiring you to devote more of your budget than necessary to running payroll.

Our SurePayroll by Paychex review can tell you more.

Pricing

SurePayroll by Paychex has only two plans, which means it isn’t particularly scalable for growing organizations. However, it’s nearly impossible to beat SurePayroll by Paychex’s low monthly and per-payee fees:

- Self-Service Payroll: $19.99/month + $4/employee/month.

- Full-Service Payroll: $29.99/month + $5/employee/month.

Top nonprofit payroll features

- Built-in benefits administration with optional employee benefits.

- W-2 and 1099 form generation.

- Affordable multi-state payroll available as an add-on.

- Time-tracking and accounting software integrations.

Pros and cons

| SurePayroll by Paychex pros | SurePayroll by Paychex cons |

|---|---|

|

|

Justworks: Best PEO solution

Our star rating: 4.2 out of 5

Justworks is one of the top PEO companies, or professional employer organizations, in the U.S. These co-employment companies partner with nonprofits and other organizations, taking care of their HR and payroll tasks and leaving them free to focus on their organization’s daily operations and overall mission.

Why we chose it: Professional employer organizations aren’t right for every nonprofit, but you might find them useful if you’re spending more time dealing with hiring and payroll than you can afford. While Justworks isn’t the only PEO that works with nonprofits, it’s one of the best thanks to its low per-employee starting price, transparent pricing and fully automated payroll.

Our Justworks review can tell you more.

Pricing

Unlike most PEOs, Justworks lists its prices upfront. It’s a good pick for nonprofits, which have unique financial transparency requirements and donor obligations:

- Basic: $59/employee/month.

- Plus: $109/employee/month.

While both plans include the same payroll features, only the Plus plan includes benefits options. Justworks Hours, Justworks’ time-tracking program, costs an additional per-employee fee per month.

Top nonprofit payroll features

- Enterprise-level benefits for nonprofit employees.

- 24/7 customer service.

- Thorough payroll reporting features.

- Well-reviewed mobile app for employees.

Pros and cons

| Justworks pros | Justworks cons |

|---|---|

|

|

QuickBooks Payroll: Best QuickBooks Online integration

Our star rating: 4.1 out of 5

QuickBooks Payroll is Intuit’s cloud-based payroll product. It goes hand in hand with QuickBooks Online, one of the most popular accounting software solutions around the globe.

If you use both Intuit products, your QuickBooks Online general ledger will update automatically every time you run payroll. You’ll always have the most up-to-date financial information at your fingertips, which is particularly crucial for nonprofit organizations that are uniquely accountable to donors and other stakeholders.

Why we chose it:

Honestly, QuickBooks Payroll doesn’t have as many nonprofit-friendly features as most other payroll providers we reviewed here. However, it does sync perfectly with QuickBooks Online — which is one of the best accounting programs for nonprofits large and small.

If you’re used to QuickBooks Online’s outstanding interface and worry about the learning curve you might get with another nonprofit software provider, QuickBooks Payroll is a natural next step.

Our QuickBooks Payroll review can tell you more.

Pricing

QuickBooks Online Payroll lists pricing for its three payroll plans upfront and online:

- Payroll Core: $50/month + $6/employee/month.

- Payroll Premium: $85/month + $9/employee/month.

- Payroll Elite: $130/month + $11/employee/month.

While Payroll Core has a higher base price than comparable payroll programs, its higher-tier plans have a lower per-employee fee than most other nonprofit payroll providers. Put another way, the more employees you have, the more money you’ll save with QuickBooks Payroll compared to other providers.

Top nonprofit payroll features

- Seamless integration with QuickBooks Online, one of the top accounting software products for nonprofits.

- Employee benefits administration.

- Optional employee benefits in all 50 states.

Pros and cons

| QuickBooks Payroll pros | QuickBooks Payroll cons |

|---|---|

|

|

Our methodology

We follow a strict set of criteria outlined in our payroll methodology to determine which payroll software to review and to calculate our star ratings. In addition to the criteria listed on our methodology page, we gave special emphasis to the following data points while reviewing the nonprofit payroll software on this list:

- Affordability.

- Built-in integrations with nonprofit-specific apps.

- Time-saving automations.

- 501(c)(3)-specific reporting features.

We also use an in-house algorithm to calculate our star ratings which breaks down into the following formula:

- Pricing: Weighted to 25% of the total score.

- General payroll features: Weighted to 35% of the total score.

- Ease of use: Weighted to 15% of the total score.

- Customer service: Weighted to 15% of the total score.

- Our expert’s firsthand experience and personal opinion: Weighted to 10% of the total score.

How to choose the best payroll software for your nonprofit

Now that you know your nonprofit payroll service options, it’s time to start narrowing down your list. If you’re trying to choose between payroll software providers, we recommend signing up for a free trial (or at the very least scheduling a free demo) so you can get a feel for the software. You’ll want to ask yourself questions like the following:

- Is the software’s interface easy enough for me to understand that I don’t have to dedicate too much time and resources to figuring it out?

- Does this software have all the payroll features I need to get my people paid accurately and on time?

- Is this software available at a price my organization can afford?

- If more people than just me will be using this software, will they also find it easy to use? Can I set up custom admin permissions to ensure employee data stays safe and secure?

Remember, too, that while most payroll software providers don’t advertise discounts for nonprofits on their sites, it never hurts to ask. Before committing to a payroll software plan, discuss your organization’s unique mission with your sales rep to find out if their company is willing to offer a discount for nonprofits.

Frequently asked questions

How much does QuickBooks Payroll for nonprofits cost?

QuickBooks Payroll for nonprofits starts at $50 per month plus $6 per contractor or employee paid per month. Nonprofits can take advantage of 50% for the first three months or opt into a 30-day free trial.

Bear in mind that if you forget to cancel your trial, you’ll be charged automatically for the next month when your trial expires. QuickBooks does not offer refunds.

Do 501(c)(3) organizations pay payroll taxes?

Yes, 501(c)(3) nonprofits must pay payroll taxes. Payroll taxes include your employees’ federal and state income taxes and FICA taxes (Social Security and Medicare taxes). Nonprofit employers also pay the employer’s share of the employees’ FICA taxes.

How much does Gusto cost for nonprofits?

Gusto for nonprofits starts at $40 per month plus $6 per contractor or employee paid per month. If your organization only pays contractors, Gusto costs $6 per contractor paid for the first six months. The price then increases to $35 a month plus $6 per contractor per month.

How can payroll software help nonprofits?

Managing payroll can be time-consuming and complex, especially for organizations with limited resources that rely on volunteers, grants and donors to stay afloat. Payroll software helps by automating payroll processes, minimizing tax compliance risk and saving time so you can focus on your mission instead of on finances. Payroll software can also help you avoid common payroll mistakes that can result in unhappy employees, confused donors and unwanted messages from the IRS.