- Best overall: ADP

- Best for scalability: Gusto

- Best for tax handling: Paychex

- Best for customizable payroll reports: QuickBooks

- Best for easy setup: Paylocity

- Best for payment flexibility: Square Payroll

Managing payroll can be daunting for small business owners, particularly for one-employee businesses. Running a one-employee business means you are not just responsible for your business growth but are also faced with handling payroll operations, such as tax calculations, invoicing, and record-keeping. Managing all these factors can be stressful and distracting.

Fortunately, payroll software and services can automate these payroll operations and save one-employee businesses from payroll complexities. Here is a review of the best payroll services for one employee to help you make the right choice for your company.

Featured Partners

Top one-employee payroll software: Feature comparison table

| Starting monthly price | Free trial | Can complete payroll in mobile app | Advanced reporting | Our star rating | |

|---|---|---|---|---|---|

| ADP | Custom | 3 months | Yes | Yes | 4.4 out of 5 |

| Gusto | $40 + $6 per employee | No* | No | Yes | 4.6 out of 5 |

| Paychex | $39 + $5 per employee | No | Yes | Yes | 4 out of 5 |

| QuickBooks | $50 + $6 per employee | 30 days | No | Yes | 4.1 out of 5 |

| Paylocity | Custom | No | No | Yes | 4.6 out of 5 |

| Square Payroll | $35 + $6 per employee | No | Yes | No | 4.2 out of 5 |

| Plan and pricing information up to date as of 3/29/2024. *Gusto currently offers a one month free discount on your invoice after you subscribe and run your first payroll. Other terms and conditions apply |

|||||

ADP: Best overall

Our star rating: 4.4 out of 5

ADP is a payroll services provider that offers a variety of customizable and scalable payroll solutions for different sizes of business, including products that are ideal one-employee payroll solutions. For instance, Roll by ADP is a chat-based payroll app for microbusinesses while ADP RUN gives business owners access to automated payroll tools plus basic human resource tools and benefits.

If you’d rather not deal with payroll yourself, you can choose ADP’s managed payroll service, ADP TotalSource. This PEO option takes payroll and HR processes off your hands entirely so you can focus on daily business operations. Alternatively, one-employee business owners can choose one of ADP’s payroll processing service options, where ADP hosts the processing platform while you manage data entry and validate data output.

Regardless of the option you select, ADP ensures you stay compliant with IRS and other regulations while receiving quarterly and annual reports.

Why we chose it: ADP is one of the most accessible, easy-to-use payroll software providers — not just for employers, but for their employees, too. Both you and your single employee should be able to figure out the software’s ins and outs without too much trouble.

Learn more by reading our review of RUN Powered by ADP.

Pricing

ADP doesn’t list pricing for most of its payroll solutions online. (Notably, it does list ADP Roll pricing, which starts at $39 a month plus $5 per employee per month.)

Most ADP products have multiple plans. ADP RUN, for instance, has four:

- Essential: The cheapest ADP RUN plan, perfect for basic payroll.

- Enhanced: Includes basic payroll and ZipRecruiter services.

- Complete: Includes features from the plans above plus additional HR tools.

- HR Pro: Houses a complete suite of payroll and HR services.

You’ll need a price quote from the ADP sales team to get a specific price for each category.

Features

- Automatic payroll calculation, deduction and filing.

- Automatic direct deposit.

- Quarterly and annual reporting.

- Marketing toolkit from Upnetic to help one-employee businesses build, grow and manage digital services.

- Seamless integration between time tracking and payroll.

Pros and cons

| Pros | Cons |

|---|---|

|

|

Gusto: Best for scalability

Our star rating: 4.6 out of 5

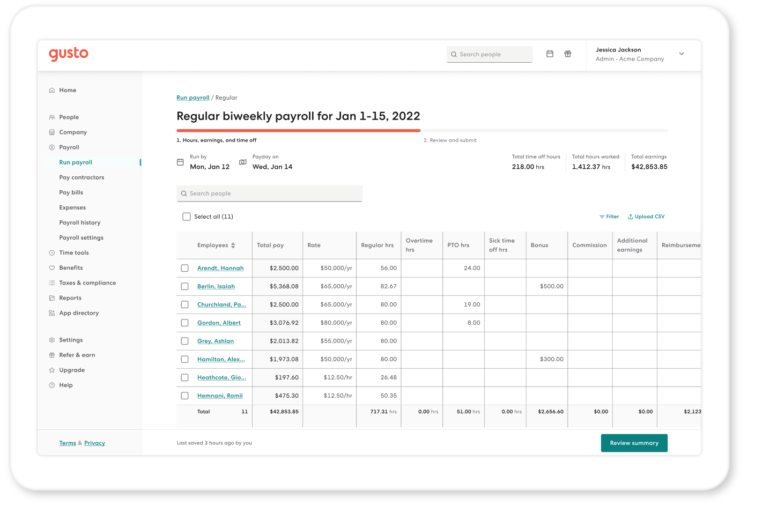

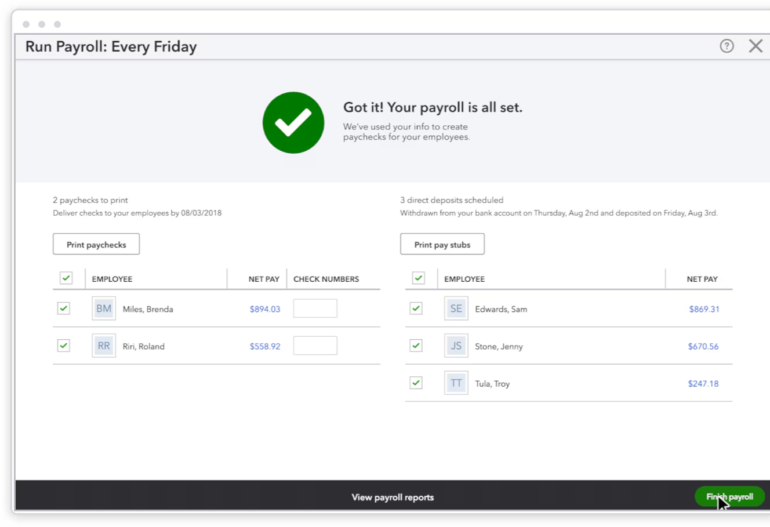

Gusto’s payroll solution consistently ranks as the top payroll software for small businesses. Specifically, it helps one-employee businesses navigate payroll complexities by automating most HR- and payroll-related tasks, including processing payroll in multiple jurisdictions and automatically submitting mandatory new-hire reports.

In addition, Gusto payroll allows you to run unlimited payroll and offers 24/7 support that addresses complaints and questions promptly. Because it has three plans, Gusto also allows for scalability, making it easier for one-employee businesses to onboard and pay employees without reworking their entire business structure.

Why we chose it: Gusto is the most popular payroll software solution in the small- and midsize-business market. It doesn’t take much time to get used to, and it integrates with hundreds of third-party apps to make your life as a business owner easier.

Learn more by reading out review of Gusto.

Pricing

Gusto’s pricing tiers are clearly stated, allowing you to know how much each plan is worth.

Gusto offers a contractor-only plan at $35 per month plus $6 per month per contractor. (The plan’s base fee is waived for your first six months of service.) Other available plans include:

- Simple: $40 per month plus $6 per month per employee.

- Plus: $80 per month plus $12 per month per employee.

- Premium: $135 per month plus $16.50 per month per employee.

Features

- Unlimited pay runs for one employee.

- Autopilot payroll feature ensures you pay employees on time.

- Unlimited contractor payments across all 50 states and internationally.

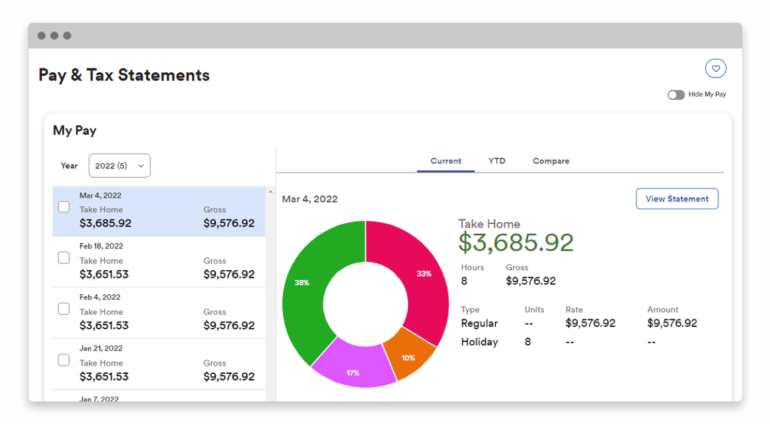

- Employees get lifetime access to digital pay stubs and W-2s in their Gusto account.

Pros and cons

| Pros | Cons |

|---|---|

|

|

Paychex: Best for tax handling

Our star rating: 4 out of 5

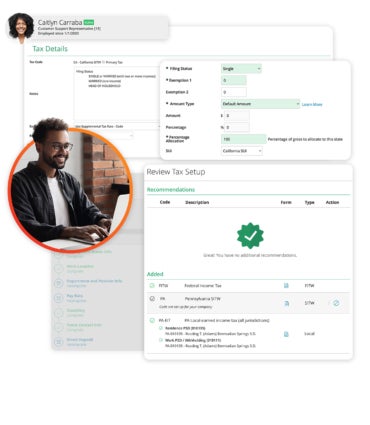

Paychex is an all-in-one payroll, HR and benefits platform designed for different levels of business. For one-employee businesses, Paychex offers a payroll package known as Paychex Flex. With Paychex Flex, one-employee business owners can access automated and manual payroll services online from desktop or mobile with the option to work with a dedicated payroll specialist.

Included in Paychex’s payroll technology are multiple payment options such as direct deposit, same-day ACH and real-time payments. In addition, customers can utilize Paychex Voice Assist, allowing them to use voice prompts to handle such activities as payroll reviews, approvals, submissions and updates.

Why we chose it: Paychex Flex offers more HR tools along with its payroll features than all other payroll providers on our list. If you’re hoping to offer competitive benefits to keep your sole employee engaged at work and attract more workers down the line, Paychex is a solid option.

Learn more by reading our review of Paychex Flex.

Pricing

Paychex Flex operates with a three-tier pricing model:

- Paychex Flex Select: Custom pricing.

- Paychex Flex Pro: Custom pricing.

- Paychex Flex Enterprise: Custom pricing.

Features

- Automatic tax filing.

- Multiple payment options for employees, including paper check and on-demand pay.

- Built-in Paychex Voice Assistant feature helps perform payroll tasks quickly.

- In-app help options, including tutorials and how-to guides for users.

- Payments can be processed on autopilot or manually.

Pros and cons

| Pros | Cons |

|---|---|

|

|

QuickBooks: Best for customizable payroll reports

Our star rating: 4.1 out of 5

QuickBooks Online Payroll is another popular one-business payroll solution with features to help one-employee business owners automate payroll processes. The platform is designed to help you streamline your tax and financial information to get your payroll processes up and running.

With QuickBooks Payroll, one-employee businesses can stay compliant as the platform collects all necessary information from bank account details, tax ID numbers, IRS filings and W-2s. Also built into QuickBooks are over 15 customizable payroll reports, which enable users to view bank transactions and payroll tax deductions in real-time.

Why we chose it: QuickBooks Online is one of the world’s most popular accounting software solutions. While QuickBooks Payroll isn’t quite as widely used, its interface is just as user-friendly and intuitive as QuickBooks Online. If you’re worried about making common payroll mistakes as you get used to the new process of payroll, working with an interface you already understand could help.

Learn more by reading our review of QuickBooks Payroll.

Pricing

The pricing plans available for one-employee businesses using QuickBooks Payroll are:

- Payroll Core: $50 per month plus $6 per employee per month.

- Payroll Premium: $85 per month plus $9 per employee per month.

- Payroll Elite: $130 per month plus $11 per employee per month.

QuickBooks Payroll offers a typical discount of 50% off the base price for your first three months of service. Alternatively, you can sign up for a 30-day free trial of any plan.

Features

- Automatic payroll tax filing.

- Multiple options for payroll report customization.

- Seamless QuickBooks Online syncing for real-time payroll and accounting updates.

- Optional health insurance benefits, retirement plans and workers’ compensation insurance.

Pros and cons

| Pros | Cons |

|---|---|

|

|

Paylocity: Best for easy setup

Our star rating: 4.6 out of 5

Paylocity is another payroll tool that provides one-employee businesses with a comprehensive and easy-to-use solution for managing payroll. It can work for one-employee businesses that want to offer their employee a full suite of HR services, but because it’s so comprehensive (and therefore more expensive than other payroll solutions for one-employee ventures), Paylocity might be best for businesses that plan to aggressively scale up from a small business to a fully fledged enterprise.

With Paylocity, you can automate your payroll processes and ensure accuracy and compliance with various state and federal regulations. The tool also offers features such as direct deposit, tax filing and year-end reporting, making it a valuable resource for businesses looking to streamline their payroll operations. In addition, the software is designed to be intuitive and user-friendly, with customizable dashboards and reports that provide you with insights into your payroll operations.

Why we chose it: Both you and your employee will be impressed with Paylocity’s user-friendliness. Its interface is fairly intuitive, and it’ll beautifully manage benefits and human resources as an all-in-one solution — it even has communication features.

Learn more by reading our review of Paylocity.

Pricing

Paylocity’s payroll information is only available upon request from the sales team.

Features

- Time tracking integration for accurate payroll calculations.

- Desktop and mobile payroll management.

- No additional fee for quarterly and year-end tax reporting.

- Benefits management.

Pros and cons

| Pros | Cons |

|---|---|

|

|

Square Payroll: Best for payment flexibility

Our star rating: 4.2 out of 5

Square Payroll is a payroll solution designed to assist small businesses in managing their payroll operations online. Its basic payroll features include automatic payroll and tax filing across federal, state and local tax jurisdictions, plus end-of-year tax form filing with no additional fee. Thanks to its supremely affordable contractor-only plan, Square Payroll is ideal for employers of contractors, and due to its easy syncing with Square POS, it’s also a good fit for restaurants that need simple payroll with tip distribution.

Square Payroll is extremely flexible and enables users to pay their employees with manual paychecks, direct deposit or the Square Cash application. Payments can also be scheduled weekly, biweekly or bimonthly. In addition, Square Payroll is compatible and integrates with a range of other payment processing and accounting software, such as Square POS and QuickBooks Online

Why we chose it: Square is flexible, affordable and accessible. Learn more by reading our review of Square Payroll.

Pricing

Square Payroll offers two pricing plans:

- Full-service payroll: $35 per month plus $6 per month per employee.

- Contractor-only payroll: $6 per month per employee.

Features

- Straightforward timecard integration.

- Automatic tip tracking and importing via Square POS.

- Specialist support for users switching payroll providers.

Pros and cons

| Pros | Cons |

|---|---|

|

|

Key features of one-employee payroll software

When choosing payroll software for a one-employee business, these are essential features to consider in your selection process.

Scalability

Although one-employee business owners operate independently and determine how to offer their products and services, this does not write off the organization’s chances of expansion. As a result, business owners should consider that they might need to scale their business in the future and choose a payroll solution that promises scalability.

Scalability, in this sense, could be the ability of a payroll platform to incorporate and accommodate the growing needs of your business, which could come in the form of expanding your client network to different parts of the globe where you have different tax laws.

SEE: Payroll Processing Checklist (TechRepublic Premium)

Automation

Automated payroll makes it easy to set your payroll on autopilot. Running a one-employee business where you are responsible for different aspects of business growth and the risks involved can be taxing. Having a payroll solution where all you need to do is set up the software to handle payroll even when you are not looking is a feature your preferred payroll solution should have.

User-friendly

The ability to use any business software tool without encountering many difficulties is critical to how successful you will be while using the tool. The same goes for payroll software and services for one-employee businesses. Consider a solution with an easy-to-navigate interface, straightforward installation, explicable reports, flexible integration and abundant resources on how to use the software.

Security

Payroll involves the movement of funds, invoicing, tax details and other forms of personally identifiable information. With data breaches on the rise, cybercriminals are often attracted to such information and look for vulnerabilities to exploit. Therefore, it’s important to consider if the payroll software you want meets industry security standards.

Customization

Customization is an essential feature of modern payroll tools. The best payroll solutions should allow you to customize various features and modules, such as reports and setup processes.

As a one-employee business owner, you’re likely more interested in having things run as easily as possible. Having a software solution you can customize to your standard is one way to achieve that. For instance, your payroll report might come with extensive information you consider irrelevant and distracting. However, with customization, you can tailor this report to fit your needs.

How do I choose the best one-employee payroll software for my business?

Choosing the best one-employee payroll software for your business requires careful consideration. Here are some tips on how you can make the right choice.

Consider the features

Payroll software features vary widely depending on the vendor and package you choose. Some software packages offer basic features for calculating taxes, generating pay stubs and making direct deposits, while others offer more advanced features like vacation and sick time tracking, employee benefits management and tax filings. Determine which features are essential for your one-employee business and choose a payroll service that meets those needs.

Check for compliance

Payroll taxes can be complex, and as a one-employee business owner, you may not be familiar with all the tax laws and regulations that apply to your business. You want to choose payroll software that automatically calculates and deducts payroll taxes and ensures all taxes are filed correctly and on time. Check if the software offers features such as automatic tax calculation, tax form generation and reminders for tax deadlines.

Consider integrations

If you are already using accounting or bookkeeping software, it is essential to choose a payroll solution that integrates with your existing solution. Integrations help you avoid manual data entry and reduce the risk of errors.

Look for affordable pricing

Price is a significant factor when choosing payroll software. As a small business owner, you need to ensure that the software fits your budget. Look for payroll software that offers affordable pricing with no hidden fees or charges.

Determine whether the software you want offers a free trial period and, during the trial period, evaluate whether software features justify the cost. For instance, ADP offers a three-month free trial, which should be enough time for you to determine whether this tool suits your business.

Consider customer support

Even with user-friendly software, you may need assistance or have questions or concerns about the software. Therefore, choosing payroll software with excellent customer support is crucial. Check if the software offers multiple support channels like phone, email, chat or a knowledge base. From there, choose a software vendor that provides responsive, knowledgeable and helpful customer service.

Methodology

Our selection process for the best payroll software for one-employee businesses involved comparing the most popular options and assessing key features that are unique to each. We narrowed our choices to the best six solutions based on criteria such as payroll automation, tax filing, ease of use, customization parameters and reporting capabilities. (Learn more about how we rate and review software and assign star ratings by reading our payroll software review methodology page.)

To generate star ratings, we used a proprietary in-house algorithm that calculates ratings based on the following categories:

- Pricing: 25% of total score.

- Features: 35% of total score.

- User-friendliness/ease of use: 15% of total score.

- Customer service and reputation: 15% of total score.

- Expert analysis and hands-on experience: 10% of total score.

Read next: The best payroll software for nonprofits